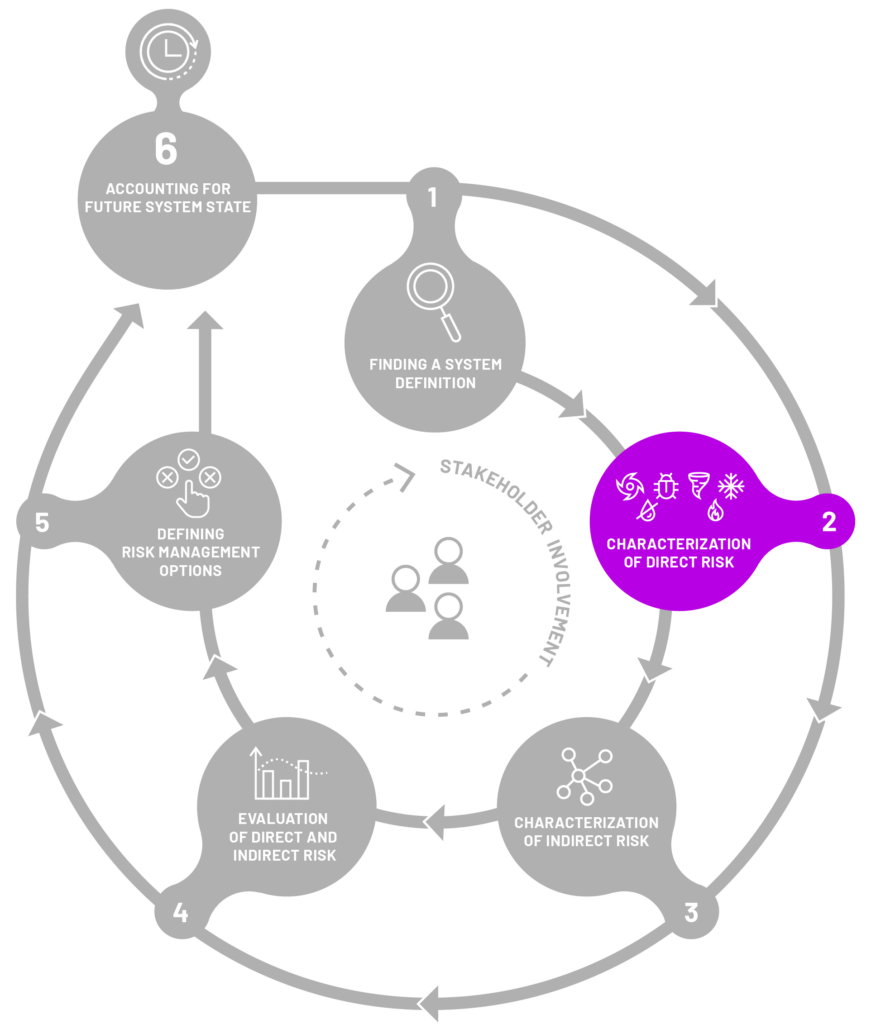

CHARACTERIZATION

OF DIRECT RISK

The objective of Step 2 is to assess the immediate risk to system elements that have come into direct contact with a hazard or a multi-hazard event. The goal is to measure this risk using straightforward metrics, where possible. It’s important to recognize that the impact on the affected system elements can be either tangible (physical) or intangible (immaterial). The impacts can be measured using methods like monetary values or also other indicators, such as loss of life, which would difficult to express in monetary terms.

The below figure and text give you an example of how direct effects of multihazards can manifest.

For example, a household can be directly impacted by flooding, leading to damage to the house and property (see Individual Element at Risk 1 below). Similarly, an earthquake can simultaneously directly affect another household (see Individual Element at Risk 2 below), causing damage to the home and property. An insurer may experience direct impacts from both as both of these households belong to the system of this insurer, leading to losses through claim payments. Likewise, a government can be directly affected by losses from infrastructure damage and the need to provide immediate assistance to the affected households (i.e. Individual Element at Risk 1 and 2). This impact extends to failures in insurers, like insurers of last resort

Guidance protocol questions

The following are questions that can help decision-makers, stakeholders, and relevant parties in successfully walking through step 2 of the framework. Consider this set of questions as an initial guide for your investigation, recognizing that it is not an exhaustive list.

Direct impacts

- What are the direct impacts that occur due to contact of the system elements with a hazard/multi-hazard event?

For instance, the destruction of roads and interruption of transportation due to an earthquake, tourism sites affected, and potential loss of life.

As mentioned above, think of a variety of direct impacts, and take into account both those that are tangible and intangible. Also, note which can be quantified and expressed in monetary terms and which cannot be.

Direct risk metrics

- What are the main direct impacts of interest for the system owner?

For example, the transport sector might be interested in minimizing interruption to the transportation system.

- What are the metrics for these impacts?

For example: loss of access to health facilities, loss of numbers of fishing and transportation ships and number of insurance claims

Dynamics of exposure, vulnerability, and impacts

- For a multi-hazard scenario and characterization of direct risk, take into account how vulnerability and exposure change.

For instance, buildings can be structurally weakened by an earthquake and, therefore, are more vulnerable in case of a consecutive earthquake. Similarly, a population’s exposure to floods might change if people are moved to a flood-prone area following a different hazard (e.g., fire).

- If considering a multi-hazard scenario, how do direct impacts appear in time as the multi-hazard scenario is progressing?

For instance, if we have a Hazard X in t=0 with a direct impact I1, what is the direct impact I2 of a Hazard Y in t=1?

To exemplify the process of navigating through this stage of the framework, we have conceptualised an imaginary multi-hazard event in the Danube Region, drawing inspiration from real historical events in the area. This serves as a practical illustration of how to approach this step and how to address the guidance protocol questions mentioned earlier, using our hypothetical scenario as a guide.

CONCEPTUAL EXAMPLE

There was a drought in the Danube Region (e.g. the 2015 or 2022 drought) that left severe consequences across sectors. After several months, the region is hit by a severe flood (e.g. the 2006 flood) causing severe loss and damage.

Example of direct impacts

- road damages due to severe drought (e.g. cracking)

- destruction of road infrastructure due to floods

- loss of navigability on the river due to droughts

- crop losses

- damages of properties (households)

- insurance losses

Example risk metrics

Annual losses in agricultural production, proportion of insured households experiencing financial losses, days of navigation lost

Dynamics of vulnerability and exposure

E.g. road infrastructure weakened by droughts the consecutively hit by floods